The cause of the 2008 financial crisis - excessive leverage

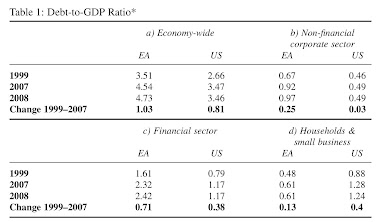

As I mentioned in my previous blog, leveraging is a common practice for investment banks, but excessive leverage combined with other factors can lead to disaster. From the figure, we can clearly see that the banking industry and the whole market were too high during the financial crisis in 2008, which was also one of the factors that triggered the financial crisis this year.

Some argue that leverage starts with homeowners, and more than the vast majority of the rise in household debt is mortgage debt, loans taken out by investors to buy homes. Mortgages with at least a 20 percent down payment give homeowners a leverage ratio of 5 to 1, but subprime mortgages require 5 percent or less and raise borrowers' leverage ratios to more than 20 to 1. So even a small loss would be a subprime loan in trouble.

The other view is that innovation leads to credit expansion and investment, but without money and excessive leverage, there would not have been countless bets on rising asset prices, causing market chaos.

One argument against excessive leverage is that leverage is just a symptom of an underlying problem. But if left unchecked, it will cause great damage.

评论

发表评论